Date: 4 December 2001

The Tempe, Ariz.-based National Association of Purchasing Management said Monday its index of business activity rose to 44.5 in November from 39.8 in October, its lowest point in nearly 11 years.Analysts had been expecting a reading of 39.0.

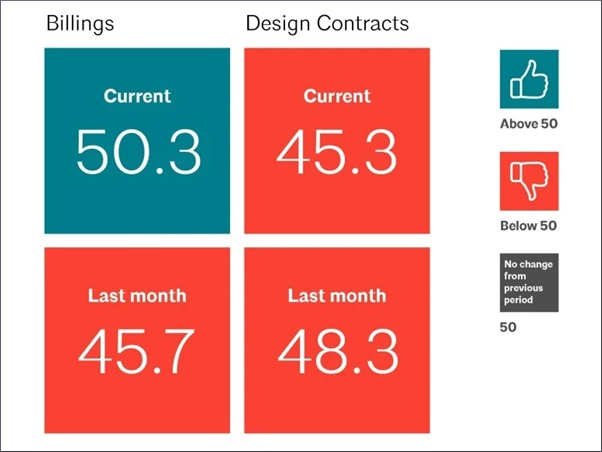

An index above 50 signifies growth in manufacturing, while a figure below 50 shows contraction.

"After absorbing last month's aftershock of the terrorist attacks, the manufacturing sector showed surprising resilience in November," said Norbert J. Ore, who oversees the monthly report.

Ore said he was encouraged with the results, particularly the new orders component of the index, which had one of its best-ever increases of 10.5 percentage points. However, it's too soon to tell whether manufacturers are headed for a quick recovery, he added.

"The manufacturing decline is now in its 16th month, and even with this month's signs of encouragement, it takes time to build a recovery across the sector," Ore said.

The NAPM measure is closely tracked because it offers an early reading on the health of the manufacturing sector in November. Its index is based on a survey of purchasing executives who buy the raw materials for manufacturing at more than 350 companies.

Separately, the Commerce Department reported Monday that personal spending rose by record 2.9 percent in October, led by a a surge in purchases of autos and other durable goods. But personal income failed to rise October for the second straight month, reflecting the huge number of layoffs in following the Sept. 11 terrorist attacks.

Another report showed construction spending rose 1.9 percent in October, first monthly gain since April.

The markets were lower following the reports, with the Dow Jones industrial average off 136 points to 9,715 and the Nasdaq down 28 points to 1,902.

The manufacturing sector has been particularly hard hit this year and began its decline long before other segments of the economy.

The National Bureau of Economic Research last week confirmed that the country had entered a recession last March, the first downturn in a decade. The government also reported that total economic activity fell at an annual rate of 1.1 percent in the July-September quarter.

The Federal Reserve, which has already cut interest rates 10 times in what amounted to an unsuccessful attempt to keep stave off a recession, is expected to reduce rates for an 11th time when the central bank meets next week.

The NAPM's new orders index climbed to 48.8 percent in November, up from 38.3 in October. Economists also were cheered by a decline in the prices manufacturers paid last month for their raw materials as the index that measures that component fell to 31.6 from 32.5, largely a result of the drop in energy prices.

"That historically bodes well for the economy," said Gary Thayer, chief economist at A.G. Edwards & Sons in St. Louis. "Normally when we see a drop in prices, it helps companies reduce their costs, but gives consumers the ability to stretch their income more and perhaps increase their demand for manufactured goods."

Of the 20 industries tracked by the NAPM, only five reported growth, Ore said; in contrast, no industries showed growth in October. Those that improved in November were: tobacco, food, apparel; instruments and photographic equipment; and glass, stone and aggregate.

Add new comment