Date: 26 October 2023

This release is a summary of Glaston Corporation's January-September 2023 interim report. The complete report is attached to this release as a pdf-file. The release is also available on the company's website at the address www.glaston.net.

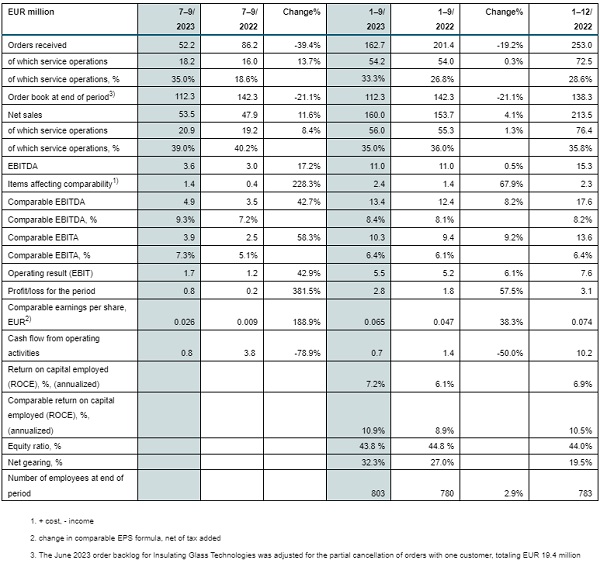

JULY–SEPTEMBER 2023 IN BRIEF

- Orders received totaled EUR 52.2 (86.2) million

- Net sales totaled EUR 53.5 (47.9) million

- Comparable EBITA was EUR 3.9 (2.5) million, i.e. 7.3 (5.1)% of net sales

- The operating result (EBIT) was EUR 1.7 (1.2) million

- Comparable earnings per share were EUR 0.026 (0.009)

JANUARY─SEPTEMBER 2023 IN BRIEF

- Orders received totaled 162.7 (201.4) million

- Net sales totaled EUR 160.0 (153.7) million

- Comparable EBITA was EUR 10.3 (9.4) million, i.e. 6.4 (6.1)% of net sales

- The operating result (EBIT) was EUR 5.5 (5.2) million

- Comparable earnings per share were EUR 0.065 (0.047)

GLASTON’S OUTLOOK FOR 2023:

Net sales estimate specified, comparable EBITA estimate unchanged

In the third quarter of 2023, the increasing market uncertainty and more cautious customer behavior continued. The activity in the architectural market further decreased, and the environment of softer demand is expected to continue in Europe and China also in the final quarter of the year. In the Americas, the demand prospects are better. Despite the softening of the markets, demand continues to be supported by the need to modernize existing equipment and the strong megatrends driving interest in energy-efficient glass solutions.

Throughout 2023, Glaston has focused on the execution of its strategy, which will incur costs and capital expenditure ahead of the effect on revenue growth. With ongoing geopolitical tensions and increasing uncertainty in the global business environment, a higher-than-normal level of unpredictability is related to customers’ investment decisions.

Due to the prevailing uncertainties, Glaston Corporation specifies its net sales estimate and expects net sales in 2023 to grow marginally or to be on the same level as reported for 2022. Glaston continues to estimate that comparable EBITA will increase to EUR 13.7−15.7 million. In 2022, the Group’s full-year net sales totaled EUR 213.5 million and comparable EBITA was EUR 13.6 million.

(Previous outlook: Despite the prevailing uncertainties, Glaston estimates that its net sales will increase in 2023 from the levels reported for 2022 and estimates comparable EBITA to increase to EUR 13.7−15.7 million.)

PRESIDENT & CEO ANDERS DAHLBLOM:

Despite the softer market environment, our overall third-quarter performance was solid. In the review period, market activity in the architectural glass segment further decreased, mainly in the EMEA region. This affected the demand for Heat Treatment equipment in particular, while demand for Insulating Glass equipment picked up from the previous quarter.

Due to the exceptionally high year-on-year comparison for the Insulating Glass equipment business and the softness in the Heat Treatment equipment business, our received orders came in lower year-on-year, totaling EUR 52.2 million. Considering the prevailing market situation and the typical third-quarter slowness, our order intake performance was good.

Third-quarter net sales were up 12% and totaled EUR 53.5 million with good development both in Heat Treatment and Insulating Glass. The EBITA margin was strong at 7.3%. Profitability improved year-on-year and also compared to the previous quarter. This was mainly due to strong volume development throughout our architectural business.

The Services business continued to be affected by the slowdown in market activity. Investment hesitation was noted for bigger investments and order intake for upgrades was modest. Supported by the improved order backlog, Services grew its net sales by 8%.

In the review period, we initiated actions to respond to the prevailing market situation and protect our future profitability. Due to the weakening market conditions in both the Architectural and Automotive markets and the unsatisfactory profitability development in the Automotive segment, we adjusted our operations in Finland and Switzerland mainly by terminating some employment contracts, reducing the use of external services and general cost control measures.

To speed up our strategy execution, our new organization was implemented as of October 1. Key reasons for the change is to enhance the customer experience with lifecycle solutions and to be closer to the customer interface. With the reorganization, we also want to further increase our internal collaboration and harmonize our ways of working. We are also reviewing our strategy to reflect the changes in the new organization. Modifying the new organization in a relatively short time has required a lot of work and I want to thank the Glaston team for their good work and commitment during the reorganization phase.

Safety continued to be high on our agenda. The systematic work to further develop the safety culture has continued, including e.g. safety training in all our locations, and reporting on near-miss observations has increased during the third quarter. In the January−September period, we had 9 lost-time accidents and LTIFR was 7.5.

We remain confident about the competitiveness of our offering and ability to close deals in the final quarter. At the same time, we expect market volatility and uncertainty to continue for the remainder of 2023. Therefore, we specify our net sales estimate and expect that our net sales in 2023 will grow marginally or be on the same level as in 2022. For comparable EBITA, our estimate remains unchanged, and estimate comparable EBITA to increase to EUR 13.7−15.7 million.

ANALYST AND PRESS MEETING

Glaston’s CEO Anders Dahlblom and CFO Päivi Lindqvist will present the financial result to analysts, investors and media representatives today at 11:00 (Finnish time) in English.

The live audiocast can be accessed through the link: https://glaston.videosync.fi/q3-2023-results/register

An on-demand version of the presentation will be available on the company's website later during the same day.

For further information, please contact:

President & CEO Anders Dahlblom, tel. +358 10 500 500

Chief Financial Officer Päivi Lindqvist, tel. +358 10 500 500

600450

600450

Add new comment